History of Litecoin and Bitcoin

The conception of Bitcoin in 2009 stemmed from an anonymous figure’s strive for a decentralized digital currency. Litecoin followed, entering the scene in 2011, purposed by the need for crypto complimenting Bitcoin’s functionalities, while also focusing on faster transaction times. Over time, both experienced diverse shifts in value, technological upgrades, and public sentiment, shaping their current market positions.

Origins of Bitcoin

Bitcoin, the first cryptocurrency, was introduced to the world by an enigmatic entity known as Satoshi Nakamoto in 2008. Satoshi’s identity, whether an individual or a group, still remains one of the biggest mysteries in the crypto world.

In their seminal 2008 whitepaper, Nakamoto laid out the foundational concepts of Bitcoin. This was the birth of a decentralized digital currency which was free from the control of any government or any central authority.

Despite its revolutionary technology & concept, Bitcoin faced challenges in its early years. The idea of digital value was new and took time to gain traction among the public and the tech community.

However, the tide turned in Bitcoin’s favor after 2010, as tech enthusiasts, futurists, and some enterprising investors began to fathom its potential. This sparked the rise of Bitcoin adoption, setting the stage for the current crypto revolution.

Origins of Litecoin

Litecoin entered the crypto arena on October 7th, 2011, a brainchild of former Google engineer Charlie Lee as he presented the Litecoin Whitepaper in person. Designed to be the ‘silver‘ to Bitcoin’s ‘gold‘, it signaled a new approach for digital currencies, placing emphasis on scalability and speed.

Litecoin’s introduction of the Scrypt hashing algorithm revolutionized computing requirements for crypto mining, making its acceptance and scalability quicker in the dense crypto market.

Lee incorporated a different hashing algorithm – Scrypt, prompting a shift in the computing requirements for mining. His vision lies in Litecoin’s fundamentals, creating a true peer-to-peer cryptocurrency with shorter confirmation times.

Achieving significant milestones, Litecoin marked its presence with the adoption of Segregated Witness (SegWit) in 2017, enhancing its speed and scalability even further. Its market acceptance escalated post this technological transition.

Continuing on its evolutionary trajectory, Litecoin has proved its mettle in terms of its transactional capabilities and low fees, establishing it as a viable payment method. Today, Litecoin stands strong, even amid a congested crypto market, mirroring Lee’s ambitious vision.

Technology and Blockchain

Unraveling the technology that fuels Bitcoin and Litecoin discloses the foundation of distributed ledger technology, an innovative peer-to-peer system that ensures transparency, authenticity, and security. Bitcoin’s underlying tech mainly revolves around the original blockchain model, setting the standard for subsequent cryptocurrencies. In contrast, Litecoin’s technology, although largely inspired by Bitcoin’s, exhibits key modifications, such as a faster block generation rate and an alternative proof-of-work algorithm, resulting in notable transaction processing speed and mining efficiency improvements.

Blockchain Basics

A blockchain is best understood as a digital ledger, where unalterable transaction data can be securely stored, accessible across a decentralized network. The technology underpins the grand mechanics of cryptocurrencies, driving security, trust, and ensuring seamless peer-to-peer transactions.

Blockchain, the foundational technology of cryptocurrencies, has fortified these digital assets against fraud. The decentralized nature of blockchain makes hacks incomparably challenging, promoting enhanced cyber-resilience, and ensuring the integrity of each transaction, a vital underpinning in cryptocurrencies.

Bitcoin’s Blockchain

Bitcoin’s blockchain, as integral to its functioning, offers an intense scrutiny experience. A decentralized, public ledger records all transactions chronologically, making Bitcoin’s value proposition secure and transparent.

Through a process referred to as ‘proof of work’, miners play a pivotal part in maintaining and securing Bitcoin’s blockchain, essentially providing the backbone of the network.

Every Bitcoin transaction is compiled in ‘blocks’ which are then added onto the existing ‘chain’. This becomes a permanent, unalterable record of all past transactions.

The role of miners extends beyond transaction validation. These network participants compete with each other to solve complex mathematical problems, thereby forging new blocks.

Blockchain’s transparent nature means each Bitcoin transaction is traceable, eliminating double-spending attempts. This inherent feature accords Bitcoin its trustless nature, underpinning its widespread adoption among cryptocurrency investors.

Litecoin’s Blockchain

Litecoin’s blockchain is unique, employing a Scrypt hash function, enabling faster and more efficient processing. Moreover, its greater max supply and quicker block generation time are testament to its ability to handle large transaction volumes seamlessly.

Miners play a vital role in Litecoin’s blockchain. By solving complex mathematical problems via the Scrypt function, they validate transactions ensuring network stability. This decentralized proof-of-work mechanism provides security against double-spends, keeping Litecoin’s blockchain robust.

Key Differences

When examining Bitcoin and Litecoin, core disparities include transaction speed, cap supply, the mining algorithm used, and the overall market stance. Each provides unique benefits depending on users’ trading requirements and investment objectives.

In a comparative study, Bitcoin’s blockchain leads in terms of security and widespread acceptance, while Litecoin’s faster block generation time and adoption of innovative technologies, like SegWit and Atomic swaps, make it an equally formidable competitor in the crypto race.

Transaction Speed

In the Bitcoin vs Litecoin debate, transaction speed plays a crucial role. The close scrutiny of Bitcoin and Litecoin transaction rates reveals a clear distinction.

- Bitcoin’s average transaction time is about 10 minutes.

- Litecoin’s transaction execution is faster with an average time of 2.5 minutes.

Transaction Fee

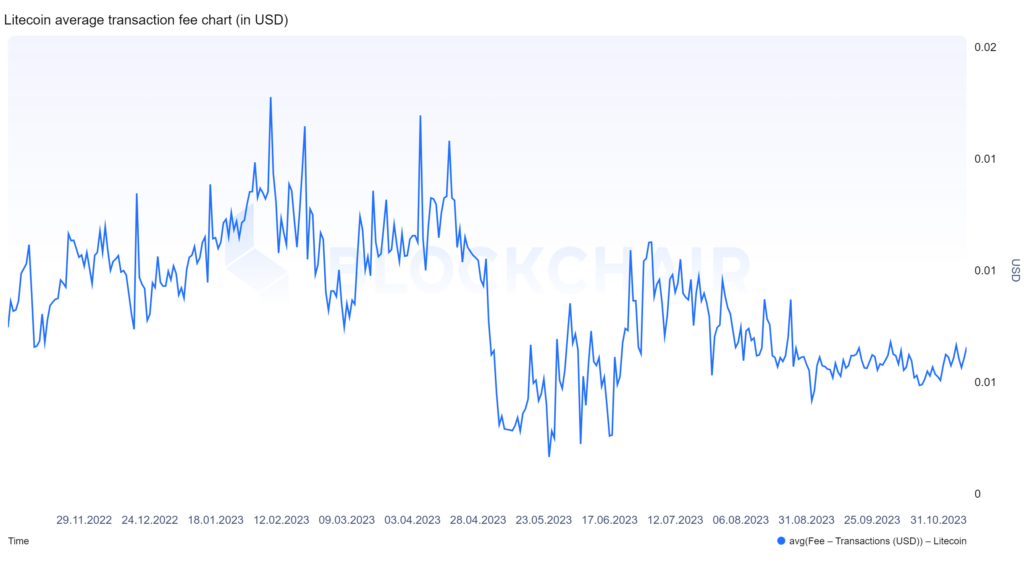

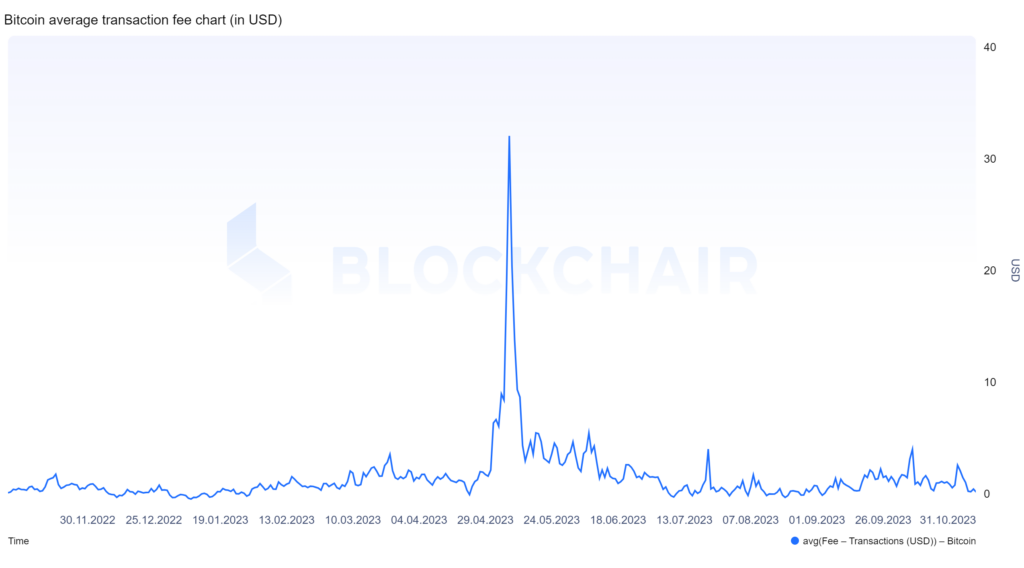

Transaction fees are a major subject when it comes to Litecoin vs Bitcoin. With the increased transaction speed, Litecoin has also significantly lowered the fee associated with Blockchain transactions versus Bitcoin

- Bitcoin’s average transaction fee in 2023 has been 2.774 USD.

- Litecoin’s average transaction fee in 2023 has been 0.0063 USD.

Supply Limit

The supply limit of a cryptocurrency determines its scarcity and potential value; Bitcoin is limited to 21 million coins, while Litecoin quadruples this figure to a maximum of 84 million coins. This constraint plays a pivotal role in the value and longevity of both cryptocurrencies.

- Bitcoin has a hard cap supply of 21 million coins

- Litecoin offers a higher supply limit of 84 million coins

- The supply limit is a key factor affecting the potential future value and scarcity of Bitcoin and Litecoin

- A higher supply limit can indicate a lower price per coin and greater transaction accessibility in the long term

- Differences in supply limit can significantly alter market positioning and investment returns

Mining Algorithm

Undoubtedly, one of the most defining differences between Litecoin and Bitcoin resides in the realm of mining algorithm. Bitcoin uses a more complex and resource-intensive Proof of Work algorithm known as SHA-256, while Litecoin relies on a memory-bound algorithm, Scrypt, designed to be more accessible and equitable.

- Bitcoin Mining Algorithm: SHA-256 – increases the complexity of computations, requiring high power machinery.

- Litecoin Mining Algorithm: Scrypt – more accessible, promotes fairer and wider participatory mining.

Community and Development

The development and evolution of both Bitcoin and Litecoin rely significantly on their respective communities. They aid in decision-making, contribute to technological breakthroughs, support network security, create use cases, and drive general acceptance.

- Countless developers contribute their time and knowledge to improving Bitcoin’s source code.

- The Litecoin community has proven to be very innovative, introducing new features that eventually make their way to Bitcoin.

- Both communities stand as pillars of the cryptocurrency market, their engagement shaping the direction and pace of Bitcoin and Litecoin’s development.

Market Position

In comparison, Bitcoin is the undisputed leading cryptocurrency with the largest market capitalization, a globally recognized brand, and widespread adoption. Whereas, Litecoin, often dubbed as silver to Bitcoin’s gold, holds a respectable position and stands among the top twenty cryptocurrencies.

Analyzing the market dominance, Bitcoin retains the top spot due to its greater liquidity and worldwide accessibility. Conversely, Litecoin’s less dominance is offset by its technological advantages and continuous innovations that make it a promising contender in the vast crypto world.

As of October 2023, Bitcoin has a market cap of $670 billion vs Litecoin’s market cap of $5.1 billion.

Where to Buy Litecoin with credit card

When looking to buy Litecoin, you want to find a platform that is regulated and a place that offers you customer service in case of problems and questions. Make sure the platform you use is allowed in your jurisdiction.

In most countries, you can buy Litecoin with credit card at Bitinvestor. Bitinvestor offers you low fees and lots of local fiat currencies to pay with when buying Litecoin. Keep in mind that buying Litecoin and other cryptocurrencies comes with great risk and that the cryptocurrency market is volatile.

How to sell Litecoin

If you have Litecoin lying around that you want to get rid of, you’ll need to find a platform or person that allows you to sell your Litecoin. Make sure the platform is regulated or the person is trusted. In order to sell your Litecoin, you must send your Litecoin from your cryptocurrency wallet to the recipient.

If you use Bitinvestor to sell Litecoin, you will be able to get paid in DKK, EUR, USD, or GBP to your local bank account. It’ll cost 0.5% and you’ll have the money in 10-20 minutes with GBP, EUR, and DKK or 1 business day with USD.

Litecoin’s Unique Features

Uniqueness-defining Litecoin are features like Segregated Witness (SegWit), quicker block generation, atomic swaps, and a different mining algorithm, Scrypt. Not merely can these attributes enhance transaction speed, but they also foster increased security and overall network efficiency.

In comparison to Bitcoin, Litecoin’s prominent features enable it to navigate the digital landscape more swiftly, and perform cross-chain transactions—imbuing it with distinct practical advantages. Active development and innovation ensure Litecoin stays ahead in the game, making it an attractive choice for investors.

Segregated Witness (SegWit)

Litecoin was swift to adopt the significant protocol upgrade, Segregated Witness (SegWit). Unlike Bitcoin, Litecoin’s smaller user base allowed it to enact the SegWit protocol with relative ease and speed.

Implementing SegWit resolved the issue of transaction malleability in Litecoin. By separating the witness information, the unique transaction identifiers became immutable, adding a layer of security.

SegWit also meant more transactions could fit into each Litecoin block. Consequently, a higher transaction throughput was achieved, improving the speed and efficiency of transactions.

Beneficially, Litecoin’s SegWit protocol lays the groundwork for future advancements like the Lightning Network, presenting vast potential for scalable off-chain transactions. This innovation underscores Litecoin’s commitment to continuous development for its users.

Faster Block Generation Time

Unlocking Litecoin’s speed takes us to its unique ability of faster block generation time. A Litecoin block is confirmed roughly every 2.5 minutes, which is four times faster than Bitcoin’s process that averages 10 minutes per block.

The rapid block generation time plays a crucial role in speeding up the transfer of transactions, therefore positioning Litecoin as a more efficient cryptocurrency for transactions. It serves to reduce wait time, increase capacity, and expedite transaction confirmations – making Litecoin a top choice for investors who prioritize speed.

Atomic Swaps

Atomic swaps usher in a new age of interoperability for Litecoin, offering a defining difference compared to Bitcoin. This feature enables cryptocurrency transactions to seamlessly take place between different blockchains, enhancing the coin’s utility and appeal.

In essence, Atomic Swaps are a technological innovation that allows Litecoin to create a flexible environment for transactions. They eliminate the need for a third party, ensuring secure and efficient crypto exchanges.

This feature significantly magnifies Litecoin’s trading capabilities by enabling direct trading with other cryptocurrencies, compared to Bitcoin which necessitates crypto exchanges as intermediaries. The absence of such a third party not only speeds up transactions but reduces incurred costs.

Innovation sits at the heart of Litecoin, and Atomic Swaps are a testament to this fact. This unique feature pushes the boundaries of conventional cryptocurrency transactions, redefining how Litecoin is seen in the crypto sphere and how it interacts with other cryptocurrencies.

Scrypt Algorithm

The Scrypt algorithm is a key feature that sets Litecoin apart. It’s a password-based key derivation function, designed with a higher degree of parallel processing that reduces the advantage of using custom ASICs, making mining more accessible and decentralized.

In contrast, Bitcoin uses the SHA-256 mining algorithm, which favors processing power. The shift to expensive, specialized hardware for Bitcoin mining has led to a concentration of mining power.

The difference in mining algorithms between Litecoin and Bitcoin highlights the diverse paths taken by these digital currencies in maintaining their networks, with each having unique implications for their respective miners and network security.

Active Development and Innovation

Litecoin’s active development and innovation keep it afoot in the dynamic crypto landscape. It not only embraces pertinent upgrades but also pioneers innovations, offering investors a versatile and forward-looking digital asset.

Comparing the development timelines of Litecoin and Bitcoin reveals the former’s commitment to faster adaptations and ground-breaking updates. Litecoin’s constant strive for innovation makes it a unique proposition amongst the crypto giants.

Test your knowledge